In recent years, a trend of real estate investment funds has been gaining momentum in Israel, particularly the TAMA 38 investment fund.

The story of TAMA 38 investments is complex and multifaceted, but ultimately, it represents an investment avenue that many are drawn to due to its potential high returns.

However, as with any investment, it’s crucial to first understand the background and the key players in the field in order to make informed investment decisions.

Let’s delve into the investment funds of TAMA 38, how they have developed, and how to decide whether to invest in them wisely.

Sure! Here’s the English translation of your content:

—

## **A Bit About TAMA 38**

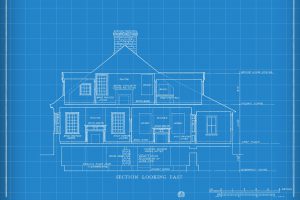

Many people are familiar with the term TAMA 38 in the context of renovating old buildings—restoring the exterior, adding housing units, and incorporating architectural elements such as balconies or elevators.

While this is how most TAMA 38 projects are perceived today, the origin of the program lies elsewhere.

The story of TAMA 38 actually begins with the geographic location of the State of Israel, specifically the Syrian-African Rift, which is a tectonic plate boundary stretching from Syria in the north to Africa in the south.

This rift has a high potential for earthquakes, and indeed, minor tremors are occasionally felt in Israel. However, the risk of a major earthquake remains very real, as has occurred in the past.

In response, during the 1980s, Israel decided to update its building codes to require earthquake-resistant construction, in order to improve safety for its citizens.

This raised a critical question: what should be done about the many buildings constructed before these standards were introduced and that lacked proper reinforcement?

That question led to the creation of TAMA 38—a national outline plan aimed at strengthening existing buildings to withstand earthquakes.

To implement the program on a wide scale, the government offered incentives to independent contractors. These came in the form of permits for additional construction as part of the renovation, which included new residential units that generated profit for the contractors, as well as increased property value for the existing residents.

This is how the TAMA 38 program we know today was born: a plan that not only strengthens buildings against earthquakes but also includes comprehensive renovations and architectural enhancements.

## **TAMA 38 Investment Funds**

But the story doesn’t end there. Like many areas of the economy, this field has evolved and matured into a new investment avenue available to the public.

While many independent developers proactively approach buildings to initiate renovations and reap the profits, investment funds began to emerge with a slightly different methodology.

These funds pool capital from a large number of private individuals to finance their projects, allowing them to simultaneously undertake numerous projects and significantly increase potential returns.

For private investors, this has opened up a new path—individuals can now invest in a TAMA 38 fund and enjoy a proportional share of the project profits.

This way, all the key players benefit without any of them needing to invest a massive amount of their own capital in a TAMA 38 project:

* **Residents** benefit from building renovations that improve their quality of life and increase their property’s value.

* **Developers/Contractors** are able to complete the work and earn profits without needing substantial personal capital, thanks to funding from the investment fund.

* **The Fund** acts as a bridge between investors and developers, enabling simultaneous work on multiple projects.

* **Investors** gain access to a promising real estate investment opportunity without an excessively high entry barrier.

## **Choosing the Right Investment Fund**

Nonetheless, this is still an investment, and investors must carefully evaluate where they place their money.

There are many funds specializing in TAMA 38 projects, and in order to make wise investment decisions, it’s important to thoroughly examine the nature of the fund, the projects, and more.

To guide your research, here are some essential questions to consider when evaluating different funds:

* **Fund Expertise:** Confirm that TAMA 38 projects are indeed a specialty of the fund, ensuring it is familiar with the regulations and requirements unique to these projects.

* **Project Location:** As always in real estate, location is a key factor. Analyze the project’s location to assess its potential value.

* **Developer:** Ultimately, the project’s success heavily depends on the developer’s capabilities. Ensure they have relevant experience and a strong track record.

* **Bank Financing:** Check whether the project has bank support. Projects with bank backing are typically considered more secure. If no bank financing exists, investigate why.

* **Expected Returns:** Evaluate the projected returns relative to the project’s profitability and associated risks.

* **Project Duration:** It’s not enough to know the expected return—you should also understand the timeline. Unlike stock market investments, real estate profits are usually realized only after project completion.

* **Fund Investment Structure:** Understand how the fund operates. Does it invest in a single project or multiple ones? What is the profit distribution order? These and other questions should guide your choice of fund.

—

Let me know if you’d like this formatted for a website or as a brochure as well.

What are the buyers looking for in the next property you’re going to sell?

What are the buyers looking for in the next property you’re going to sell?

How the Dollar Value Impacts Real Estate

How the Dollar Value Impacts Real Estate

Capital Gains Tax Discounts and Purchase Tax Reductions in 2025 (Also for Investors)

Capital Gains Tax Discounts and Purchase Tax Reductions in 2025 (Also for Investors)

Rules and Considerations When Examining Boundaries and Plot Demarcation

Rules and Considerations When Examining Boundaries and Plot Demarcation

Should You Invest in a TAMA 38 Investment Fund?

Should You Invest in a TAMA 38 Investment Fund?

Contractor from Birth – The Complete Guide to Building a Private House

Contractor from Birth – The Complete Guide to Building a Private House