The new building regulations limit the scope of construction in central Tel Aviv to only about thirty thousand apartments over the next ten years. What impact might this have on current projects?

The master plan approved by the Tel Aviv Municipality includes significant restrictions on construction in the city center, which may lead to rising prices in the near future as currently ongoing projects become rare. The approved additional construction according to the new plan amounts to a minimal number of about thirty thousand housing units in the old city center, since large areas will be designated as preservation zones. These areas include parts of Ibn Gabirol Street, the Yarkon River, and Bugrashov Street. Those who read the map correctly can understand that this situation makes investing in the city center at this time especially worthwhile.

The general intention and the prevailing spirit from the local committee indicate a trend to limit building permits for plans that exceed the new regulations, allowing exceptions only in rare cases until 2025. Among other things, the construction of new towers will be prohibited, leading to a continuous increase in the prices of old apartments, especially compared to new projects. Therefore, demand for apartments in central Tel Aviv, along with the trend of splitting apartments, continues to grow, despite the fact that real estate in the southern areas is a cheaper investment.

Currently, prices for three-room apartments averaging 70 sqm in the old city center start at 38,000 ILS per sqm, while new projects in this location sell for an average of about 58,000 ILS per sqm. It is well known that demand for apartments in established neighborhoods in Tel Aviv is always higher compared to other areas. Many real estate companies are aware of the situation and are promoting numerous new and luxurious projects in this sought-after location. This is the case with the Assuta Village Towers, which stretch between Yehoshua Ben Nun, Arba Ha’Aratzot, and Jabotinsky streets, comprising no less than twenty-six floors and one hundred fifty-five housing units, alongside luxurious amenities such as a pool, spa, and gym. If apartment prices in this project ranged from 43,000 ILS per sqm in 2009-2010, today they have already climbed to 75,000 ILS and above.

Another example is the 42-floor Mayer Tower at the corner of Rothschild and Allenby streets, including 141 apartments, offering residents a gym, spa, pool, art exhibitions in the lobby, and a business lounge. Apartment prices, which were initially marketed at an average of 40,000 ILS per sqm, have already soared to 80,000 ILS per sqm and higher. Similarly, the White City project located in the picturesque Neve Tzedek neighborhood, within walking distance of the beach, Carmel Market, the Station Complex, and Rothschild Boulevard, features a twenty-nine-floor tower with 129 housing units. This project also offers a luxurious lobby with a security desk, a residents’ club, a gym, and a guest lounge, along with a smart home system in every apartment. Four-room apartments in this project started at 52,000 ILS per sqm and have surged to 75,000 ILS and above.

In summary, Tel Aviv Municipality’s master plans maintain a low supply of housing construction, increasing the attractiveness of investing in the city center, where project prices are on a steady upward trend.

What are the buyers looking for in the next property you’re going to sell?

What are the buyers looking for in the next property you’re going to sell?

How the Dollar Value Impacts Real Estate

How the Dollar Value Impacts Real Estate

Capital Gains Tax Discounts and Purchase Tax Reductions in 2025 (Also for Investors)

Capital Gains Tax Discounts and Purchase Tax Reductions in 2025 (Also for Investors)

Rules and Considerations When Examining Boundaries and Plot Demarcation

Rules and Considerations When Examining Boundaries and Plot Demarcation

Should You Invest in a TAMA 38 Investment Fund?

Should You Invest in a TAMA 38 Investment Fund?

Contractor from Birth – The Complete Guide to Building a Private House

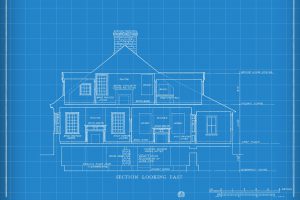

Contractor from Birth – The Complete Guide to Building a Private House